Overview of the Executive Budget

|

|

|

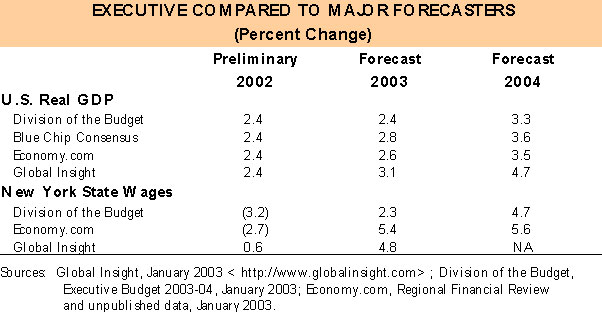

PART A Last year, during a time of recovery from one of the most devastating events in our nation's history, we found ourselves re-evaluating what was significant in our lives. This year we again face a changed landscape that will cause us to identify what is critical to our future. Giving our children a strong educational foundation is an American ideal that is unwavering. Maybe more so than in the years prior to September 11th, New Yorkers, like most Americans, understand that an educated citizenry is an essential cornerstone to our democratic way of life. The Assembly Majority is committed to preserving these values for all New Yorkers. We are determined to ensure the provision of a sound basic education for all our children in New York State. Parents and their children have the right to expect the leaders of our State to provide exemplary leadership, especially during challenging economic times. Dismantling what has been built as a foundation for educational progress is tantamount to permitting the State to balance its fiscal needs on the backs of our children. Unfortunately, the Governor's proposed budget for the 2003-04 school years allows for no educational vision. The Executive budget cuts aid to education by $1.24 billion, or 8.5 percent. It eliminates virtually all early childhood programs including prekindergarten, K-3 class size reduction, and full day kindergarten. The Executive budget also chooses to treat other vulnerable populations with disregard. The budget cuts $70 million in support of schools serving only severely disabled children and eliminates distinct financial support for all children with disabilities. The Governor's budget also eliminates aid for after school programs, consolidates resources for students with limited English proficiency and reduces aid for professional development programs. Nearly every aid category specifically targeted to high need children, or designed to help students increase their achievement has been wiped out. That is the educational future that this budget envisions, and that is the wrong choice that this Governor makes. In fact, the Governor's record on investing in aid to education has been dismal. From the first year of his administration through the current 2002-03 school year, the aggregate amount that he has been willing to increase educational expenditures for our kids, their teachers, and our communities has been a total of $1.7 billion. The Assembly's intervention and insistence on education as a priority has driven the enacted increases in education to a total of $4.6 billion, a financial commitment that is truly meaningful for our children and their future. For nearly a decade, the Regents have provided the leadership for implementing standards based reform. In fact, it is only within this past year, with the passage of the No Child Left Behind (NCLB) Act, that the nation has begun to catch up. By raising the bar, we have changed the landscape forever. We have raised expectations for each of New York's children, but, they cannot do it alone and they cannot do it without resources. The Assembly Majority has always realized that when we invest consistently, adequately and wisely in education, we are also investing in the State's future economic wealth and human capital. A first class, high quality education for our children is a priority we must continue to adhere to. Our multi-year LADDER program has provided many children with the strong, sound start for the challenges of higher standards and improved student achievement by focusing on priorities such as early childhood education, reduced class size, and afterschool programs. The Universal Prekindergarten program has served more than 200,000 four year olds. The Class Size Reduction program has supported the creation of nearly 2,500 additional classrooms, providing a more individualized classroom for nearly 50,000 children in this year alone. Full day kindergarten has gotten an estimated 27,000 five year olds off to a good start and extended day programs are currently providing a safe environment for approximately 80,000 children after every school day. We must not abandon our children during times of uncertainty, and must instead provide an equitable distribution of resources necessary to support all children reach their full potential. Unless we act to mitigate the wrong choices reflected in the Executive budget, school districts will be forced to shoulder the shift of the financial burden, and local taxpayers will bear the brunt of these extraordinary cuts. The Federal government's recent passage of the No Child Left Behind Act (NCLB) will challenge us to focus our attention and resources on those students who have the greatest needs in order to ensure that all children will succeed. In fact, Federal money that New York State receives will be at risk if we fail to craft a sound, forward thinking, future directed education for our children. We cannot afford to let our education system crumble. Our children are worth it, and it is essential to a bright and promising future. Continuing the Assembly LADDER Program Universal Prekindergarten The Assembly majority has worked diligently to develop and maintain sound policies that promote school readiness and early intervention for all New York's preschool age children. Based on these premises, in 1997, the Legislature enacted LADDER's Universal Prekindergarten program, a multi-year plan to provide for universal access and appropriate resources for the establishment of prekindergarten programs in all school districts. This legislation provided New York's public school districts and private early childhood providers with the ability to build a supportive and nurturing community network, thereby providing all youngsters with an educational head start. The prerequisite skills learned in an exemplary prekindergarten program set the path for young children to benefit from the rigors of higher standards for grades K-3. Universal Prekindergarten has an undeniable educational benefit for participating children, which must be maintained. It is clear that investing in high quality prekindergarten experiences for children defrays costs of more expensive interventions in the future, such as special education, and remediation. One of the most prominent studies on the benefits of participating in a prekindergarten program is the High/Scope Educational Research Foundation study. This study documented the effects of preschool child development programs on children from poor communities in the Ypsilanti Public Schools in Michigan. The study followed these children for three decades and concluded that the investment in high quality preschool education far outweighed any costs the community would face had these same children not had access to pre-k. More recently, the studies of prekindergarten programs have found shorter term effects that underscore the High/Scope research. In the Michigan School Readiness Program, a State funded initiative serving about 24,000 four-year-olds each year who were considered at risk, students were found to be better prepared for school intellectually and socially; more likely to achieve greater school success; and demonstrated higher passage of the State's reading and mathematics tests (Highscope Educational Research Foundation, Schweinhart, June 2002). New York's Universal Prekindergarten program has also experienced similar success. Children in these districts begin kindergarten with more of the basic skills needed to succeed and a broader conceptual foundation upon which to build future learning. When, in addition, districts offer full day kindergarten, the children have an even greater advantage in meeting the rigorous demands of the Regents higher learning standards. In fact, many school districts where children have the opportunity to attend prekindergarten have shifted their level of kindergarten instruction to accommodate the advanced level of their incoming students. New York State school districts have overwhelmingly responded to implementing and expanding a Universal Prekindergarten program. In 1998, the Universal Prekindergarten program served 18,200 children at a cost of $56.3 million. In the 2002-03 school year, nearly 60,000 children are being served at a cost of just over $200 million. Over these past four years, more than 200,000 four year olds have had the advantage of a prekindergarten program. As an indication of the recognition of the value of prekindergarten to a child's ongoing educational experience, it is important to note that participation has increased even from the 2001-02 to this school year in spite of fiscal constraints in many school districts. New York State is now regarded nationally as a model program (see Figure 1). However, the Executive budget has chosen to recommend complete elimination of Universal Prekindergarten, which is a step backwards - clearly a wrong choice.

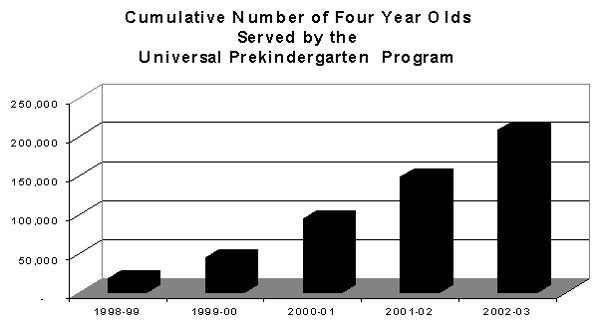

Class Size Reduction In 1997, as an integral part of the LADDER plan, the Assembly majority was successful in ensuring the passage of a groundbreaking initiative authorizing a class size reduction program in grades K through 3. Districts were provided with funds for teacher salaries and startup costs for each new classroom. The Assembly majority believed that this investment in smaller classes would provide children with a more personal, individualized environment in which to set the foundation of their education. Smaller class size allows teachers to provide a more effective instructional program which results in improved learning. In fact, more than 200 districts participate in this program, serving nearly 50,000 children in smaller classes, thereby providing a more individualized instructional approach. According to the Quality Counts 2003 Report by Education Week, 32 states have implemented a class size reduction program. In fact, during the 2000 school year, states spent an additional $2.3 billion on their own class size reduction programs, thereby supplementing Federal funds received to help school districts hire new teachers to reduce class sizes in the elementary grades. The public as well as experienced educators know that smaller class size is an important support to our children's obtaining the higher standards expected of them (see Figure 2).

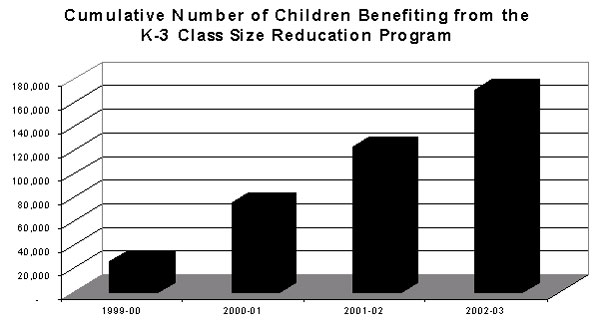

The support of class size reduction programs by the states, experienced educators, and the public continues to be bolstered by the results achieved by our children. These programs are based on sound research and many experts point to the Tennessee Project STAR study as evidence. This study included a four-year, large scale, longitudinal study of reduced class sizes in 79 schools in 42 systems and included schools in inner city, rural, urban and suburban localities. It was found that in each K-3 grade level tested, and across all school locations, the pupils in the smaller classes had the highest scores on both the norm referenced Standard Achievement Test and the criterion-based Basic Skills First Test. As one of the cornerstones of LADDER, New York's class size reduction program provides our children with an opportunity to learn and teachers an opportunity to teach at the higher levels of cognitive and affective learning. Unfortunately, the Executive has once again made the wrong choice by proposing the elimination of a program which provides an improved learning environment and benefits thousands of children in high need schools. Full Day Kindergarten Program The LADDER program emphasizes the benefits of a strong early education experience. Building upon a quality prekindergarten program, LADDER provides a financial incentive for districts looking to expand their kindergarten program into a full day educational program. For many children, the foundation is laid through participation in a quality prekindergarten program and then reinforced through the provision of a full day kindergarten program, where the positive academic and social effects for these young children are multiplied. Providing financial support which encourages districts to develop a full day program is consistent with the goals of districts looking to solidify early learning patterns. The long term educational value of full day kindergarten is well documented. The benefits to children who have participated in full day programs have included improved independent thinking and socialization. Several studies document the need for full day kindergarten and the new Federal legislation addresses the importance of early education as well. Within the NCLB legislation, Congress emphasizes reading for primary students and requires States to provide instruction grounded in scientifically based research during the first years of schooling, including prekindergarten. New York State has committed more than $47 million for full day kindergarten over the past four years serving more than 27,000 children. In fact, this program has been one of the most well regarded provisions of the LADDER initiative (see Figure 3). The Governor has chosen to eliminate support for full day programs - another wrong choice.

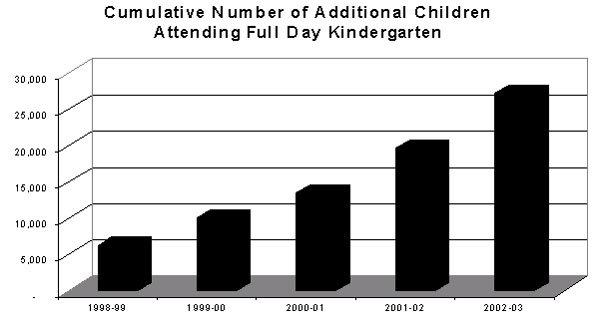

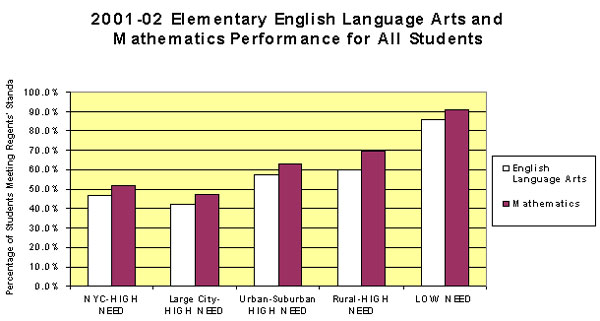

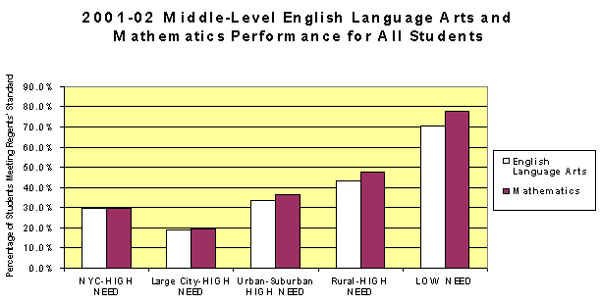

Extended School Day and School Violence Prevention A vital part of the LADDER program are the funds for Extended School Day and School Violence Prevention grants. The Assembly is deeply committed to providing not only a safe place for youth to go after the school day is over, but, even more importantly, to providing one that yields educational and social benefits. This time can be spent productively with additional educational support, as well as simply providing a safe harbor for positive recreational activities. Unfortunately, there is a growing need for after school programs which is not being met. A poll conducted by the Afterschool Alliance (June 2000) and reported by the National Institute on Out-of-School Time, noted the difficulty in finding after school programs. The U.S. General Accounting Office estimates that the current number of after school programs will meet as little as 25 percent of the demand in some urban areas. The U.S. Bureau of Labor Statistics in 2000 reported that in 59 percent of all married couple families with children 6-17 years of age, both parents work outside the home; these numbers are much higher for single parent mothers and fathers. It is extremely troubling to note that there are approximately eight million children ages 5-14 nationwide, that have no supervision on a regular basis at some point during the day. According to a 1999 report by James et al, children spend time alone after school for up to 25 hours per week (The Future of Children, 1999; Miller, et al, 1997). Children who do not have adult supervision are at a greater risk for truancy, stress, poor grades, risky behavior and substance abuse. The younger a child is when he or she begins to be left alone, the greater the risk (Dwyer, et al, 1990; Pettit, et al, 1997). Additionally, between 3 and 6 p.m. the occurrence of violent crimes - murders, sexual assaults, robberies and assaults - on juveniles triples (Sickmund, et al., 1997). The safety issue is a growing concern for a variety of reasons. According to researchers at the University of Wisconsin (1999), children who attended more supervised after school programs were rated by their teachers as having better work habits and interpersonal skills, as well as improved school attendance and better response to conflict. Currently, students who are in Extended School Day and School Violence programs in New York State benefit from activities such as academic tutoring and remediation. Bringing students up to speed academically is especially crucial at this point when graduation requirements for all students are now at their most rigorous level statewide. In addition, activities such as conflict resolution/violence prevention, and other recreational and alternative education programs are undertaken throughout the State. To date, New York has spent $125 million for these after school and school safety programs and is currently serving approximately 80,000 youngsters with an appropriation of $30.2 million. Again, the Governor has made the wrong choice by eliminating this important program. The Assembly remains committed to providing optimal after school programs, activities and settings for our youth in safe, supportive and educationally stimulating environments. School Facilities Since 1997, a crucial part of the Assembly LADDER program has been funding for improving school facilities. LADDER provided both an enhancement to the building aid reimbursement formula for the construction and renovation of facilities, as well as a distinct grant program for the upgrade and repair of existing facilities, the Minor Maintenance and Repair Program. To date, the Minor Maintenance program has provided $250 million to upgrade the quality of the school environment statewide. Unfortunately, the Executive has made the wrong choice by proposing to discontinue $50 million in funding for this important initiative. Furthermore, the Executive budget provides for additional changes to building aid calculations, which will serve to act as a disincentive to construction, reconstruction and renovation projects. A report from the State Comptroller noted unacceptable levels of overcrowding throughout the State. The report points out that changes in educational programs over the past few decades such as growth in special education, remediation, and the need for computer and science labs, have placed a significant demand on the need to upgrade and expand facilities. Compounding the problem of overcrowding, a report issued by the U.S. General Accounting Office found that 90 percent of New York's schools needed to upgrade or repair buildings to achieve good, overall condition. Few would argue that most, if not all low performing schools could benefit from facility upgrades. The correlation between schools in various stages of disrepair or schools that do not have the appropriate wiring for computers, or space for science labs, and low performance has been well established. The improvement of school buildings in disrepair must remain a priority. Educational Technology and Instructional Materials The Assembly LADDER program was unique in its recognition of the full spectrum of student needs. Over and above the aforementioned programs, LADDER also provided additional resources for instructional materials for all students statewide, as well as support for educational technology. Given the high cost of textbooks, districts are often unable to purchase up-to-date textbooks for all students. Software that changes from year to year cannot be replaced, and hardware is out-of-date almost from the time of purchase. Maintaining relevant and sufficient instructional materials has become a challenge for many districts. The importance of access to educational technology has also been emphasized with the passage of the No Child Left Behind Act of 2001. The Act clearly states as one of its goals "... to improve student academic achievement through the use of technology in elementary and secondary schools." The Act goes on to say that "every student - regardless of race, ethnicity, income, geographical location, or disability - ... should become technologically literate by the end of eighth grade..." However, the digital divide persists. Internet access, for example, is far from uniform. Having a piece of possibly out-of-date hardware in the classroom does not mean that students are becoming computer literate or learning to use technology for a variety of educational purposes. Another disparity noted in the Education Week report is that not all schools have the technical support to keep the computers running and the resources necessary to train teachers. In light of the new Federal legislation, as well as the State's uniform graduation requirements, it is imperative that none of New York State's youth are left on the wrong side of the digital divide. Students must be provided with equal access to educational technology and the opportunities it provides. Every school in the State must be able to give students access and experience with educational technology. Higher Standards Education Week, in their "Quality Counts 2003", rates New York State an "A" in their category of Standards and Accountability. Their survey examines testing, tracking and results, along with intervention policies instituted in each of the states. Under the leadership of the Regents, New York State has already made significant efforts to reach higher standards, promote more efficient policies, and provide followup and accountability. Successfully implementing the new Federal legislation cannot be realized without funding. Simply stating that low performing schools have to improve is not enough. Schools are being pressured to increase performance, but we must provide resources to improve access to successful practices and funding that will enable teachers and administrators to respond to the challenges they face. The Federal No Child Left Behind Act reinforced the Regents approach for attainment of higher standards. The intent of this law is to hold schools accountable for the achievement of all students, and to close the achievement gap between students from different backgrounds. The NCLB legislation mandates preparing, training, and recruiting high quality teachers and principals; improving the academic achievement of the disadvantaged; providing language instruction for limited English proficient and immigrant students; requiring annual improvement of students and schools on standardized tests; and an increased emphasis on reading, especially for young children. NCLB will require annual assessments to measure our students in reading and math in grades three through eight. These tests will track the performance of every school. The data must be disaggregated for students by poverty levels, race, ethnicity, disability, and limited English proficiency to ensure that no child, regardless of his or her background, is left behind. States must also report on school safety on a school by school basis. All of these requirements are costly. Unfortunately, the Governor has made the wrong choice by not making educational attainment and meeting the Regents standards and NCLB requirements his priorities. This Executive budget reduces overall aid by $1.24 billion, including $407 million in unrestricted aid, an estimated $400 million in early education initiatives, and approximately $75 million in professional development programs. While statewide results on 4th and 8th grade math and English Language Art exams indicate improvement, and some individual schools and districts posted large gains, other schools improved only slightly or even declined. It is clear that there still remain significant numbers of individual children, primarily in high need districts, needing additional help in order to meet both the Regents and NCLB standards. Though the State faces unprecedented fiscal constraints, we must make the right choice by directing our energies and resources toward education as the demands grow ever more stringent. All efforts must be made to provide the needed resources (see Figure 4 and Figure 5).

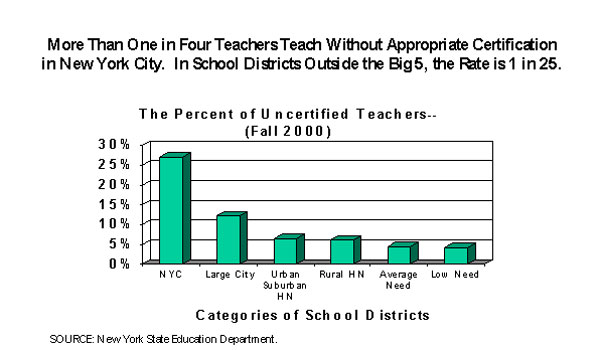

Teacher Quality and Professional Development In addition to the requirements mentioned previously, the NCLB Act also mandates that all new teachers hired with Title I funds be "highly qualified" by the current school year and, that all teachers in core academic subjects be "highly qualified" by 2005-2006. New York State's high need districts have long experienced the challenge of providing certified teachers who are able to teach courses in the disciplines for which they were trained. Data indicates that in New York's high need districts, 17 percent of the teachers are teaching without being properly certified and are in the classroom with waivers from certification requirements. In contrast, the low need districts have four percent of their teachers with waivers. These districts now have two years to solve a persistently difficult and decades old problem. New York State cannot afford to abandon its current teaching workforce. We must support ongoing, high quality professional development that is achievement focused. Resources are necessary to help teachers enhance their support of student achievement of the Regents higher standards. We must work toward directing and amplifying our resources to programs and initiatives that we know enhance effective, high quality teaching. Research has clearly shown that teacher quality and student achievement are positively related. In fact, studies using value added student achievement data have found that student achievement gains are influenced by a student's assigned teacher more so than by various other factors. Teacher attributes and experience contribute to student learning, including their general academic and verbal ability, subject matter knowledge, knowledge about teaching and learning, and the combined set of qualifications as measured by teacher certification (Darling-Hammond, 2000). Goldhaber and Brewer (2000) found strong influences of teacher certification on student achievement in high school math and science. School level analysis provides further support that teacher certification status is strongly related to student achievement. Recent studies in California also found a positive relationship between a teacher's experience level and student achievement (Betts, Rueben, & Dannenberg, 2000; Fetler, 1999; Goe, 2002). Finally, the most significant and strong predictor of student achievement was the proportion of well qualified teachers, defined as holding both full certification and a major in the field being taught (see Figure 6).

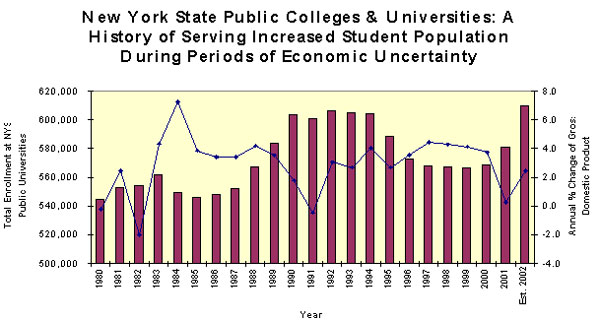

Unfortunately, the Executive budget has made the wrong choice by reducing funding for professional development programs by over $70 million. Teacher Support Aid, which acts as a retention tool in the five large city school districts has been cut by $44.9 million. Funding for Teacher Resource Centers and the Mentor-Intern program have been cut by $20 million and $3.33 million respectively. Teachers of Tomorrow, a comprehensive set of programs providing recruitment and professional development opportunities has also been reduced by $5 million. Funding is eliminated for the National Board for Professional Teaching Standards, a reduction of $500,000. The Governor once again provides no funding for Professional Development Grants. This budget would stall, and in many schools, reverse, the remarkable progress that we have made toward attracting and retaining high quality teachers. Executive Proposal for Aid to Schools The Executive proposes to decrease General Support for Public Schools by $1.243 billion, or 8.5 percent below School Year (SY) 2002-03 levels. This decrease surpasses the cuts made during the recession of the early 1990s. The wrong choices in his proposed budget will surely hurt the quality of educational programs available in New York State's public schools, further denying many children their constitutional right to a sound basic education. It is also apparent that the Executive Budget recommendations represent a massive shift in the burden for funding public education from the State to local communities. These cuts would simply transfer the financial burden from the State to individual taxpayers, a shift that would very likely hurt poor areas the most. This will force school districts to choose among raising taxes, staff layoffs, and program elimination. The Executive proposes the consolidation of nine existing formula-based aids into one aid category entitled Comprehensive Operating Aid. The Governor proposes a $407 million cut in this aid category. Reductions range from 2.00 percent to 8.75 percent for individual districts. This consolidation includes aid categories specifically targeted toward students with disabilities. By eliminating targeted aid for students with disabilities under Public Excess Cost Aid, as well as aid which prevents the referral of students to special education provided through ERSSA, the Executive provides no additional funds to districts which may experience additional placements of children into special education programs and services. The Governor also proposes funding changes in private special education. The State share of the cost for placements in private special education settings will be reduced from 85 percent to 49 percent. This reduces funding for Private Excess Cost Aid by $70.68 million. Placements in these private settings are for the most severely disabled children and are largely driven by Federal requirements. The Executive appropriates $1.11 billion for Building Aid, a decrease of $144 million below 2002-03 levels. The Governor also proposes that prospective Building Aid be paid out of a $130 million priority pool where local districts would be forced to compete for severely limited construction funding. Additional limitations include restrictions on the use of existing incentives, choice of building aid ratio and a simplification in the way the building cost allowance is calculated, all designed to reduce the State level of reimbursement. BOCES funding is cut by $129 million or 25 percent below present law levels. Beginning in the 2004-05 school year, the Executive proposes to prospectively consolidate BOCES Aid into Operating Aid. BOCES is a proven vehicle for providing cost effective quality services to component school districts. School Aid Litigation Litigation was commenced in May of 1993 in State Supreme Court challenging New York State's funding structure for New York City public schools. The lawsuit was filed on the grounds that the current system violated the Education Clause of the New York State Constitution, the Equal Protection Clause of the State and Federal Constitutions, and Title VI of the Civil Rights Act of 1964 and its implementing regulations. On January 10, 2001, the Court ruled in favor of the plaintiff on both the State Constitutional claim and the claim involving the implementing regulations of Title VI of the Civil Rights Act. The Court held that New York State has consistently violated the Education Article of the State Constitution by failing to provide the opportunity for a sound basic education to New York City's public school students. In addition, the Court found that the school financing system has an adverse unjustified disparate impact on minority public school students in violation of Federal Civil Rights regulations. The Appellate Division, First Department issued a split decision on June 25, 2002 reversing the State Supreme Court's findings on both the inadequacy of the school financing system and the disparate impact on minority public school students. The Appellate Division majority opinion held that a minimal opportunity for a sound basic education (not "more than a ninth-grade education") had been provided to public school students in New York City because there were minimally adequate educational facilities, minimally adequate instrumentalities of learning and minimally adequate teaching so as to enable students to have an opportunity to be prepared for some potential employment and to meet certain basic civic obligations (serving on a jury and voting in elections). In essence, the Appellate Division disagreed with both the trial Court's assessment of the evidence submitted and the criteria employed by the trial Court in assessing "adequacy". The plaintiffs have appealed this decision to the Court of Appeals and oral arguments are scheduled for May, 2003. Both the Mayor of New York City and the City itself are filing briefs in support of the plaintiff's appeal. In light of the current budget crisis confronting New York it remains imperative to recognize that a strong higher education system provides a crucial foundation for economic growth and the development of a highly trained workforce. In addition, the public universities of New York have historically assumed increased importance during times of economic uncertainty. As the number of students seeking a higher education at public universities increases, the need to maintain the quality and value of the public university system of New York has never been more critical (see Figure 7).

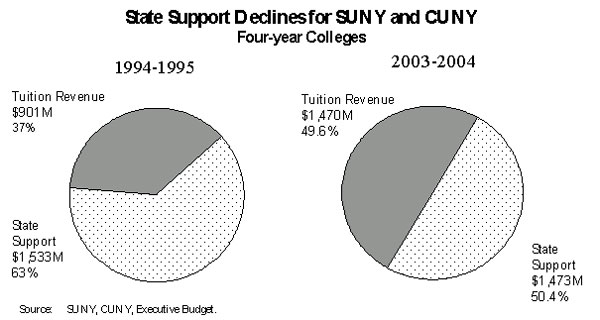

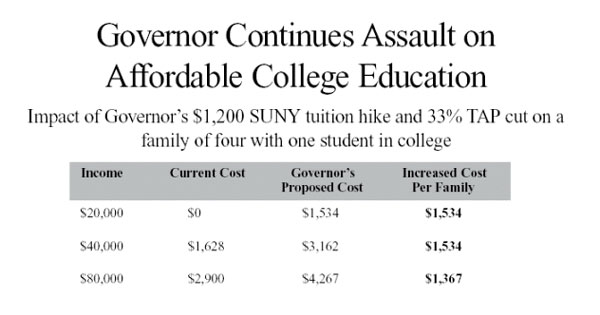

Unfortunately, the 2003-04 Executive Budget Proposal makes the wrong choice by ignoring the needed investment by the State of New York in higher education. In fact, the Governor's proposed cuts to higher education programs exceed $660 million in SFY 2003-04. Including this massive cut, higher education has been the target of a cumulative total proposed reductions totaling approximately $2.4 billion since the beginning of the "Pataki-Era". The Assembly has stood firm in its commitment to working families from across the State and has fought to restore these proposed reductions. While the Governor continues to promote the research and discoveries of New York's colleges and universities, he regrettably has yet to embrace the concept that their greatest contribution as "engines of economic growth" are the skills provided to students pursuing a college degree in New York State. The Executive Proposal would increase tuition supported appropriations by $318.3 million at SUNY and CUNY. Unstated in their appropriations is a tuition increase of up to $1,200. This would increase tuition at SUNY by 35% from $3,400 per year to $4,600 per year; and would increase tuition at CUNY by 38 percent from $3,200 per year to $4,400 per year. Unfortunately, in the same instant that the Governor proposes raising tuition, he uses this measure to lower state support for SUNY and CUNY by roughly $279.2 million from 2002-03 levels (see Figure 8).

Cost of Pursuing a College Degree Increases in New York State In 2000-01, tuition and fee costs for attending a community college in New York State was the 5th highest in the nation, roughly 88 percent higher than the national average (2002-03 Almanac of Higher Education). At a time when a significant investment is being directed toward large research institutions, the needs of the State's community colleges should not be ignored. Community colleges serve as a gateway to the pursuit of a higher education and train a significant portion of the workers needed in the new economy. Throughout much of the "Pataki Era" New York State has trailed the rest of the nation in support for higher education. According to a recent survey issued by the Center for Higher Education & Educational Finance, New York currently ranks 47th in state support for higher education per $1,000 of personal income. In fact, New York ranks 44th in the nation, or roughly 55 percent below the national average in the percent change in State support for higher education over the ten-year period from 1992-2002. Due to the lack of adequate State support for New York's public universities, the costs incurred by college students has increased in recent years. In 1995, the average cost of tuition and fees for students attending public four-year institutions in New York State was approximately $2,921. Since 1995 this figure has increased by approximately $1,141 or 39 percent to $4,062 (1995-96 and 2002-03 Almanac of Higher Education). As a result, even without the Governor's proposed $1,200 tuition increase, the average cost of tuition and fees for a student attending a public four-year institution in New York State today is roughly 16 percent greater than the national average (2002-03 Almanac of Higher Education). The Governor's proposal also provides $317.4 million for SUNY-operated community colleges and $108 million for CUNY community colleges. This reflects an overall reduction in State support of $49.4 million for community colleges. This consists of a net reduction of $41.4 million resulting from the lowering of State Base Aid support for community colleges by $345 per full time equivalent (fte) student, lowering State support by 15 percent from $2,300 per fte to $1,955 per fte. In addition the Governor would eliminate $7.9 million in support for contract courses, rental aid, and the College Discovery Program at the State's community colleges. Unfortunately, the Governor has made the wrong choice by proposing to reduce State support for these campuses in a moment when increased demands are being placed on the educational services that they provide. Access to Student Aid and Student Support Programs The 2003-04 Executive budget proposal would also reduce the Tuition Assistance Program (TAP) awards for all eligible students by one-third. The proposed 2003-04 Executive budget includes $567.5 million for the Tuition Assistance Program (TAP). This represents a $161.1 million reduction from the 2002-03 Academic Year which would translate into an overall reduction of $279 million in estimated TAP expenditures in the 2003-04 Academic Year. Unfortunately, the Governor fails to provide the necessary resources to support TAP even at such lower funding level. Instead, the Governor proposes to fund $225 million, or 40 percent of the costs of TAP in 2003-04, through a transfer of funds from the Federal Temporary Assistance for Needy Families (TANF) Program. TAP has all too often been the target of proposed reductions. In fact, since 1995-96, the Governor has proposed cutting the TAP Program on six different occasions. This across-the-board, regressive measure would directly add to the financial burden that college students across the State would bear in pursuit of a higher education. In fact, a second component of the Governor's TAP proposal is the provision of incentives that directly encourage students to fall further into debt in order to fund their educational costs. Governor Pataki proposes the creation of a new TAP Performance Award that would require students to self-finance their college education via additional student loans. Upon the completion of a degree, students would be eligible to receive a TAP Performance Award equal to the amount that their TAP award has been reduced, plus accrued interest. Finally, the Governor also proposes the creation of a new $11.6 million TAP Loan Program to support the additional student loan borrowing for students who have exhausted their Federal student loan eligibility. In 2002-03, the Executive proposed an overall reduction of $212 million in estimated TAP expenditures and advanced similar dramatic modifications that would have threatened the long-term viability of the Program. However, the Assembly fought to restore the proposed cuts to the Tuition Assistance Program.

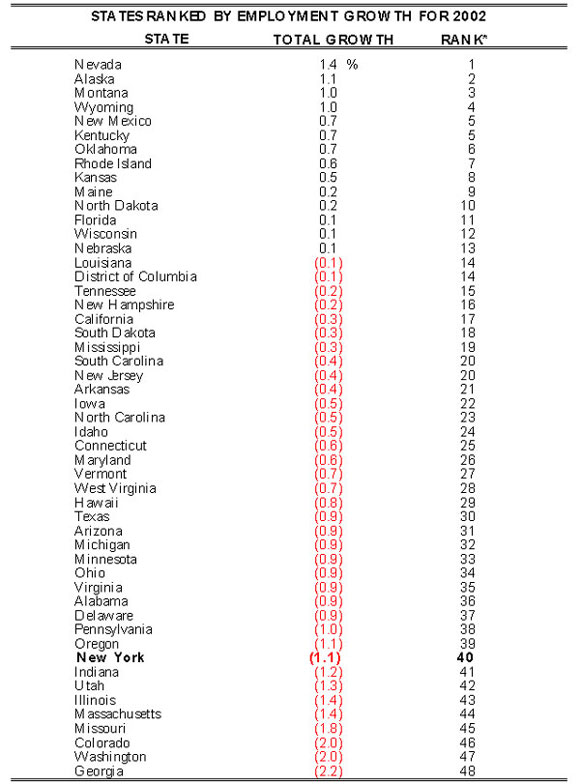

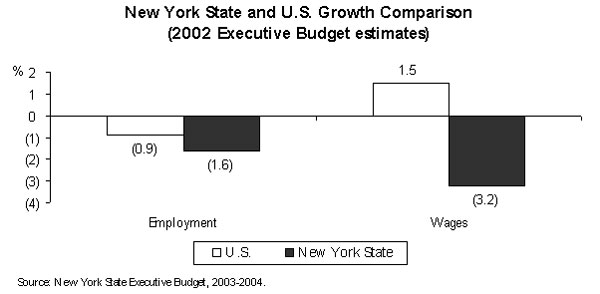

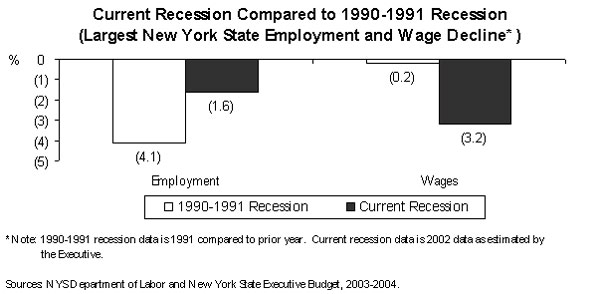

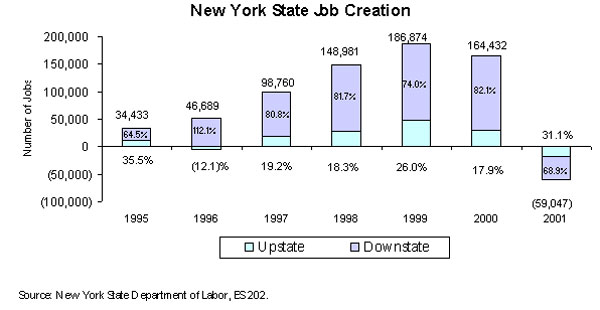

In addition to recommending the one-third reduction of TAP, the Executive Proposal targets programs focused on improving the access and affordability of a college education in New York State. This includes a proposal to reduce funding for college opportunity programs by $26.9 million, or 50 percent. This reduction reflects an Executive Proposal to eliminate supplemental student assistance to economically disadvantaged students that participate in college opportunity programs. In addition, the Executive recommends reducing support for Aid to Independent Colleges and Universities (Bundy Aid) by $18.7 million or 42.3 percent. This reflects an Executive Proposal to eliminate funding for graduate degrees conferred at New York's independent colleges and universities. Finally, the Executive Proposal recommends the complete elimination of $10 million in funding for the Science and Technology Entry Program (STEP) and its collegiate counterpart (CSTEP). These programs have proven to be extremely successful at increasing the participation rate of underrepresented and disadvantaged students in mathematics, science, technology, health-related fields. SUNY and CUNY Capital Plans The Executive proposal includes a request to provide authorization for $3.7 billion to support a multi-year plan for SUNY and CUNY capital projects. This includes $2.5 billion in bonding authorization to support a second multi-year plan for SUNY capital projects. Within this figure $1.64 billion would be directed toward academic facilities, $350 million for the SUNY Health Science Centers, $210 million for community colleges and $335 million for residence halls. In addition, the Executive includes $1.2 billion in authorization to support a second multi-year plan for CUNY capital projects. Within this figure $1.1 billion would be directed toward CUNY senior colleges and $130 million would be directed toward CUNY community colleges. Funded projects encompass critical health and safety, preservation and handicapped access projects as well as the completion of on-going projects at John Jay College and the construction of a new academic building at Medgar Evers College. Finally, the Executive proposal would provide CUNY with authorization necessary to begin planning efforts for the development of Governor's Island. Medicaid Again this year, as he has done nearly every year of his past two terms of office, the Governor is making the wrong choice by proposing massive cuts to the State's Medicaid Program in his Executive budget. These cuts and new taxes will impose a severe financial hardship on the State's ailing health care industry -- an industry that is already reeling from previous cuts, new Medicare cuts, workforce shortages, new technology costs, disaster preparedness activities, and meeting the needs of the thousands of New Yorkers who still remain uninsured. As anticipated, the State Fiscal Year (SFY) 2003-04 Executive budget proposes reinstating nearly $1 billion (all funds) in old cost containment actions that were slated to expire in March 2003. The Executive proposes new actions that would save the State over $640 million through the implementation of new cuts and the re-imposition of provider assessments (taxes) which had been eliminated in 2000. However, such action would precipitate the loss of nearly $1.6 billion in combined Federal, State, and local reimbursement to health care providers. Revenue loss of this magnitude would not only severely impact the health care industry, but ultimately would be detrimental to the "health" of New York's already faltering economy. The health care industry has a major presence in New York State, being either the first or second largest employer in nearly all of the counties in this State. Committee staff estimates that these proposed Medicaid cuts could result in a total loss of up to 38,000 jobs in New York State at a time when unemployment is already on the rise. Moreover, this job loss would result in a serious reduction in services in an industry already plagued by workforce shortages and other revenue shortfalls that have impacted the service delivery system, as demonstrated by emergency room closedowns or inordinately long waits for emergency care, as well as by the denial of home care services to many elderly Upstate New Yorkers. New cuts will only exacerbate this situation, having the potential to impact not only access to care but also the quality of such care as providers are forced to cut staff or rely on less trained staff to deliver services. Consequently, the deleterious effects of the Governor's proposals reach beyond New York's poor, elderly, and disabled citizens who rely on Medicaid for their health care benefits, having the potential to affect adversely the quality and availability of health care for all New Yorkers. Health Care Reform Act The Health Care Reform Act of 2000 (HCRA 2000) is scheduled to expire on June 30, 2003. As part of his Executive budget submission, the Governor proposes a two year extender of HCRA through June 30, 2005. The proposed legislation makes some notable but wrong changes that not only would deny or limit access to needed health insurance coverage to thousands of low income working families and their children, but also would impose a greater financial burden on health care providers and insurers, which could jeopardize their economic viability. In order to replace revenues lost through a proposed plan to securitize tobacco settlement payments, the Governor proposes the dedication of several new revenue sources to HCRA. These would include additional proceeds from the Empire Blue Cross/Blue Shield conversion to a for-profit corporation, as well as proceeds from any future conversions; anticipated federal relief funds related to the World Trade Center disaster; new Community Health Care Conversion Demonstration Project revenues; and revenues from a proposed amnesty program. More importantly, however, the Governor proposes increased surcharges on hospital and clinic patient bills and an increased assessment on health insurance companies. In many instances, these increases will be passed on to consumers in the form of higher out-of-pocket expenses or premiums. To further close the gap between lost revenues and to meet the cost of previous HCRA commitments and new General Fund shifts, the Governor recommends cuts in funding for valuable public health programs related to rural health care, poison control, emergency medical services, cancer initiatives, worker retraining, and anti-tobacco efforts. Of even greater significance, however, is the Governor's effort to achieve Medicaid savings by eliminating Medicaid coverage for an estimated 234,000 low-income children, shifting their coverage to the Child Health Plus program. Child Health Plus provides no long-term care benefits, so this action could seriously disadvantage disabled children in need of such services. Moreover, the Governor's purported commitment to lowering the numbers of New York's uninsured is defied by his proposal to eliminate health care coverage for approximately 22,000 low-income adults under the Family Health Plus program by rolling back eligibility standards. Here again, the Governor has made the wrong choice by opting to resolve the State's fiscal crisis on the backs of vulnerable populations -- the State's poor children and the uninsured. These are the wrong choices. The Executive Budget for State Fiscal Year (SFY) 2003-04 demonstrates little compassion for the plight of New York's senior citizens who struggle daily to make ends meet on fixed incomes. In fact, the Governor's budget makes the wrong choices by finding fiscal solutions on the backs of the elderly. SSI COLA Although many seniors rely totally on Supplemental Security Income (SSI) to meet their living expenses, the Governor denies passing through to them a federal cost-of-living adjustment, amounting to $14 per month for individuals and $21 per month for couples. Rather than allowing the elderly and the disabled to receive this money, the Governor proposes to divert it to defray a portion of the State's cost associated with the SSI State supplement payments. Medicaid In addition, access to quality health care is critically important for the 2.45 million New Yorkers who are 65 years of age or older. While poor children and families constitute the largest number of Medicaid recipients, this group accounts for only 21 percent of Medicaid spending. Across all service categories, the aged, blind and disabled account for approximately 73 percent of Medicaid expenditures, even though this group represents only 31 percent of recipients. Consequently, cuts to Medicaid adversely affect the poor elderly and disabled population that have no other recourse and must rely on Medicaid for needed medical care. As the elderly use a disproportionate share of hospital, home health care, and nursing home services, proposed new cuts are certain to have a severe impact on the health care services needed by the elderly. Home care costs less than one-third the cost of nursing home care and is one of the most cost-effective alternatives to nursing homes. From a human perspective, it allows elderly individuals in need of care to remain in their homes or with their families in the community, instead of being institutionalized. Among the proposals that will have the most harmful effect on the elderly are new cuts of $71.8 million (All Funds) on the home care industry. Proposed reductions in home care rates will limit the elderly's access to home care services. Severe workforce shortages have already caused some upstate providers to curtail services, thereby denying access to many families desperately in need of this care. The Governor also proposes new Medicaid reductions to nursing homes of $388.2 million (All Funds). Such cuts could severely impact the quality of care at these facilities as homes are forced to lay off workers in an industry already plagued by workforce shortages. In addition, over one-third of New York's voluntary nursing homes are already at risk of bankruptcy or insolvency ("Sounding the Alarm: New York's Nursing Homes in Financial Crisis", December 2002, New York Association of Homes and Services for the Aging). Nursing homes receive about 70 percent of their net patient revenues from Medicaid. The imposition of new cuts could spell disaster to those homes already in jeopardy, ultimately forcing them to close their doors, thereby denying access to needed care for many of the State's elderly population. Moreover, such closings could place severe hardships and mental anguish on families responsible for elderly relatives who have become too incapacitated to be cared for adequately at home. Prescription Drugs Another area of grave concern to the elderly is the rising cost of prescription drugs. Most elderly individuals take multiple drugs on a daily basis to maintain good health. The escalating costs of these drugs have become a serious cause of concern for those living on a fixed income, forcing many elderly to choose between essential medications and the necessities of life like food or rent. Even though out-of-pocket costs for prescription drugs continue to rise for the elderly population, the Governor does nothing to address this dilemma. In fact, the Governor recommends various reductions to the Elderly Pharmaceutical Insurance Coverage (EPIC) program that effectively would dig deeper into their already empty pockets by increasing fees and deductibles paid by program participants by 10 percent. His proposal to reduce reimbursement to pharmacies for filling prescriptions for EPIC participants would result in reduced access to greatly needed medications for the elderly. Given the Governor's rhetoric that recognizes the hardship ever-increasing drug costs have placed on seniors, this is the wrong solution to a pressing problem. Community Services When elderly individuals are unable to access needed community-based services, they are often forced to utilize more costly services in institutional settings, such as nursing homes. Despite this fact, the Governor's proposed budget would eliminate various community-based programs in the State Office for the Aging (SOFA) that assist low-income elderly to remain as independent as possible for as long as possible, thereby avoiding costly institutional care. The Executive's proposed budget for SFY 2003-04 eliminates funding for several programs that foster wellness, independence, and community involvement. One such program is the Congregate Services Initiative (CSI) which provides the elderly with services that promote their physical and mental well being in congregate settings, such as senior centers. The Executive also recommends the elimination of funding for Naturally Occurring Retirement Communities (NORC), a program that encourages elderly citizens to remain in their homes and in the community. Other worthy senior programs defunded in the Governor's proposed budget include: the Retired and Senior Volunteer Program (RSVP), a program that achieves the dual goal of providing services to needy citizens while providing encouragement for older volunteers to remain active in the community, and the Foster Grandparent Program, which allows the elderly to become "foster grandparents" to children with special or exceptional needs. The Governor's budget also provides significantly decreased funding for respite programs. These programs offer services that provide caregivers relief from the stresses or responsibilities of providing care to frail or disabled relatives or friends, thereby enabling the caregivers to maintain the person at home for as long as possible. Again, the Governor's decision to cut these programs is yet another wrong choice in a series of bad choices that will negatively impact New York's vulnerable elderly citizens. The Assembly has been a leader advocating for comprehensive, progressive economic development policies and has been first in line to recommend new programs to achieve economic growth and create jobs. Many of the significant economic development accomplishments over the last several years-Empire Zones, the Excelsior Linked Deposit Program, CAPCO, and Downtown Development Initiative Grants, and workforce training funds-- were Assembly initiatives. However, in spite of legislative efforts to provide innovative tools to stimulate growth, the lack of a strategic framework by the Executive has continued to contribute to the State's under-performance. During most of the past decade, although the national economy was expanding and targeted investments were made in the area of economic development, the Executive failed to provide a comprehensive economic development strategy that would have allowed New York State to capitalize on its regional strengths and the booming national economy, despite the Assembly having advanced a comprehensive, statewide economic development strategy. Evidence of these failed policies can be seen in the State's slow employment growth. During the period between 1995 and 2001, the nation's employment grew by 12.6 percent, while New York State employment grew by only 8.8 percent. If New York State employment grew at the same rate as the nation over this period, 289,900 additional jobs would have been created. New York State's job growth continues to lag behind most other states. New York State is ranked 40th in employment growth when compared to other states. Now, as New York faces what is likely to be one of its biggest budget crises in recent history, it is imperative that the foundation for economic growth not be further undermined. However, the Executive's proposed budget only continues his failed policies of the present, and also devastates the most significant job creation and retention program in New York State, the Empire Zones Program.

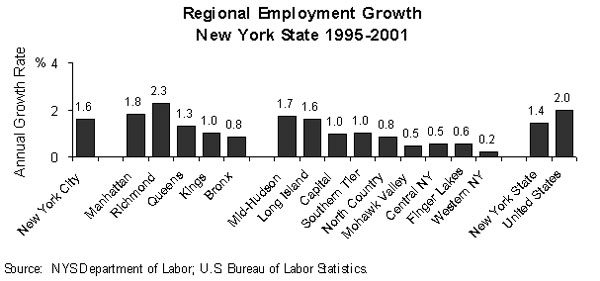

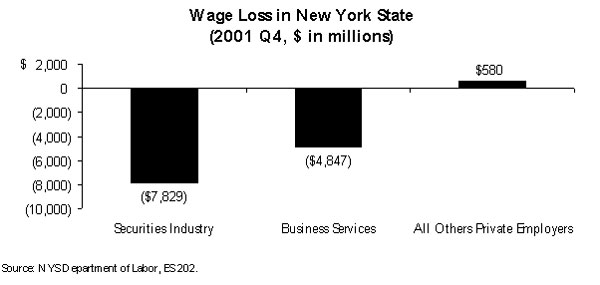

Rebuilding Lower Manhattan In the fourth quarter of 2000, two million people were employed in Manhattan private establishments and 407,700 or 20.6 percent were employed in the area below 14th Street. A year later, in the fourth quarter of 2001, immediately after the attacks of September 11th, the level of private employment fell to 1.8 million; 129,000 jobs were lost over the previous year. Below 14th Street, private employment fell to 363,300; a loss of 44,400 over the previous year. The share of private employment in Manhattan below 14th Street fell from 20.6 percent to 19.7 percent between the fourth quarters of 2000 and 2001. While there are federally funded programs intended to assist the affected businesses in Lower Manhattan, many businesses have complained about arbitrary decision-making, unnecessary paperwork, and undue delays on the part of the state agency administering the programs. It has been nearly a year and a half since the tragic events of September 11th and the clean up of the site is now complete. However, very little progress has been made either in redeveloping the site of the former World Trade Center and the surrounding area or in creating a memorial to those who lost their lives as a result of the terrorist attack. Beginning in December of 2001 and continuing to the present, the Assembly has conducted a series of hearings on the future of Lower Manhattan. These hearings have focused on the governance, transportation, economic development, small business, tourism, and insurance issues that remain unresolved. One of the more significant findings of these hearings is a strong indication of an overall lack of coordination on the part of the city, state, and federal agencies involved in the rebuilding and revitalization efforts. This has resulted in confusion and uncertainty over which agencies are responsible and accountable for the various phases of this massive undertaking. As further indication of the administrative and managerial confusion, the Federal Emergency Management Agency (FEMA) recently noted that the State has missed two deadlines for submitting proposals to fund security projects in and around Lower Manhattan for which a minimum of $418 million has been set aside. However, on January 30, 2002, the State finally submitted their $418 million security plan to FEMA. The details of this plan have yet to be released adding further speculation regarding the ability of those agencies involved in the rebuilding and revitalization efforts. The Assembly has been committed to providing direct assistance to the rebuilding and revitalization of Lower Manhattan. Through its Rebuilding the Empire State Through Opportunities in Regional Economies (RESTORE) New York Program, enacted as part of last year's State budget, the Assembly committed to provide capital support for two major initiatives that will contribute to Lower Manhattan's economic rejuvenation-the Lower Manhattan Bioscience Project and the Institute for Advanced Studies in Software and Information Technology. These projects will generate over 1,300 new jobs and add significant new incubator space in Lower Manhattan. Small businesses are the economic backbone of many diverse neighborhoods that comprise Lower Manhattan. The unprecedented loss of jobs since September 11th has been exacerbated by a drop-off in tourist traffic to Chinatown, South Street Seaport, and other communities, resulting in a precipitous drop in revenue for the many restaurants, tourist oriented businesses and retailers. Unfortunately, New York City's application to establish an Empire Zone in Lower Manhattan was rejected by the Governor's designation board. The Empire Zone concept, created by the Assembly in 2000, seeks to bolster struggling communities around the State by using a range of tax-based incentives to attract new businesses and support existing ones. Improving the Upstate Economy While the Downstate economy struggles to rebound in the aftermath of the World Trade Center attacks and the earlier downturn of the economy, the Upstate economy has also lagged under the Governor's failed economic policies. With its historic dependence on manufacturing, it suffered greatly from the recession of the early 1990's and benefited the least from the prolonged economic boom that began in the mid-1990's. Since the Upstate economy never benefited from the economic expansion, it never really entered a recession in 2001. Rather, it simply experienced acceleration in its ongoing economic decline (see Figure 9).

In fact, Upstate's job growth rate has been virtually stagnant, falling from one half of one percent in 2001 to zero growth in 2002. Furthermore, since the mid-1990's, most of the regions in Upstate New York lagged the State in annual employment growth, with four of the regions growing at less than one-half the rate of the State as a whole. Upstate also lagged the State as a whole for wage growth since the mid-1990's. New York City fueled by Manhattan, was the only region in the State to outpace the State as a whole. (see Figure 10)

A Clear Open Path for Economic Development The Assembly has long recognized that New York's economy is a collection of diverse regional economies and industry clusters. The Executive's cumbersome, top-down, project-by-project approach to economic development is the wrong choice. It has been slow to respond to differing needs across the State or provide coordinated guidance to help sectors benefit from synergistic growth, thus preventing the State's economy from reaching its full potential. New York has added new programs and organizations for economic development, but without an apparent overall economic development strategy. The development of a rapidly changing, technology-based "new economy" only further highlights the need for flexibility, creativity and responsiveness to increase the State's competitiveness in national and global markets. Although providing a more strategic focus to State economic development programs is not enough by itself to boost the State's economy, it can contribute to this effort by optimizing the State's valuable, but limited resources and by marketing the State more aggressively as an attractive business location. New York State should adopt a more comprehensive strategic policy for economic growth beyond the requirements of individual projects and companies. The Assembly has put forward this strategy to capitalize on industries in which the State has a competitive advantage and recognize the economic diversity of the State's regions. This strategic approach should emphasize programs that link research and development funding to jobs for New Yorkers in new industries as well as modernize traditional industries to increase their competitiveness. It should identify the needs of regional economies and make available assistance to revitalize urban centers and main streets, assist small business, promote tourism and maintain a state of the art workforce. Revitalizing New York's Manufacturing Sector New York's manufacturing industry has been steadily losing jobs. From 1995 through 2001, the manufacturing industry lost over 106,100 jobs statewide. Furthermore, during this same period, Upstate manufacturing employment declined at more than twice the rate of the nation (New York State Department of Labor). In order for manufacturers to remain competitive in a global economy and provide stable employment opportunities to their employees, they must be able to quickly adapt to rapid technological changes. New York State's diverse manufacturing base, which includes traditional manufacturers and the newer high tech industries, must be an integral component of a comprehensive economic development strategy to reinvigorate the State's economy. Empire Zones During the 2000 Session, the Assembly Majority transformed the old Economic Development Zones Program into the Empire Zones Program. As part of the transformation, the Assembly Majority fought for and secured changes to the Program that resulted in the creation of many of the new jobs in the State. This Program is now the most successful economic development program for attracting and retaining business in New York State. The Program provides vital tax-based incentives to businesses that locate and grow in a Zone and allows them, under certain circumstances, to operate tax-free. The State reimburses the localities for local taxes the expanding employer would otherwise have to pay. However, in his SFY 2003-04 State Budget proposal, the Executive threatens the viability of the Program by requiring localities to pick up 50 percent of the cost of the real property tax benefit offered to new Zone businesses certified as of January 1, 2004. This proposal will have a chilling effect on future job creation efforts as localities would have to weigh the cost of attracting a new business to its Zone. In addition, the SFY 2002-03 enacted State budget provided for the creation of six new zones. However, many areas of the State, both Upstate and Downstate, were overlooked by a flawed designation process controlled by the Governor. For example, the City of New York's application for an Empire Zone in Lower Manhattan, still reeling economically from the events of September 11th, as well as applications from many Upstate areas that continue to face hard economic times, were rejected in the designation process. Providing Capital Access to Small Business Small businesses are one of the major forces driving New York State's economy. Based on data for the second quarter of 2002, small businesses accounted for over 97.9 percent of businesses in New York State and employed 53.9 percent of the State's workforce (New York State Department of Labor). 1 While small businesses are the backbone of the State's economy, many small business start-ups continue to find it difficult to access much needed financing, especially venture capital. Minority and women-owned businesses are even more susceptible to failure due to their inability to obtain financing through traditional lending institutions. Originally an Assembly initiative, the Linked Deposit Program provides small businesses with access to capital through "linked loans." These funds allow companies to improve their competitiveness through an increase of sales, enhancement of product development, market expansion, and realization of operational cost savings. In the 2002-2003 State budget, funding authorization for this Program was increased from $200 million to $350 million. There is also a need for equity investment in small, start-up companies. As the "technology revolution" has changed the nature of the economy, new "knowledge-based" companies, who typically do not possess traditional forms of collateral, require equity, rather than debt financing. Yet, the business assistance offered by the State economic development agencies has tended to be of the more traditional "bricks and mortar" financing. During the technology boom in the last decade, private venture capital markets grew tremendously, taking equity stakes in new high-tech ventures allowing these firms to take their products and services to market. Although large concentrations of private venture funds were located in New York City, often the actual businesses invested in were located in other states or even internationally. Recognizing the need to keep a greater amount of venture investments within the State, the Assembly championed enactment of the CAPCO Program, that provides tax incentives for insurance companies to invest in certified venture capital funds which, in turn, make available funds to help small businesses start-up and grow in New York. Since 1998, over $280 million has been raised, with over 74 firms receiving capital critical to their growth. In addition, the Assembly supported authorization for the New York State Comptroller to allocate up to $250 million in state pension funds to qualified investment firms, which provide equity funds to technology businesses. In the SFY 2003-04 State Budget proposal, the Executive recommends the creation of a new CAPCO Program to provide additional venture capital investment in discoveries that emerge from the State's capital investment in academic research. While the Assembly welcomes the concept of new funds for CAPCO, the Governor's proposal differs significantly from prior CAPCO Programs and must be evaluated in such context. Today, the economic downturn of the past few years has the private venture capital market "entrenched in the worst slump in its history" according to the National Venture Capital Association. It is critical to New York's economic recovery that the State continues to support private sector investment in technology companies and seek creative ways to fill the gaps in various stages of venture capital investment.